Trucking Company Cash Flow Case Study: How Factoring Solved Problems for a Growing Transportation Company

Client Overview

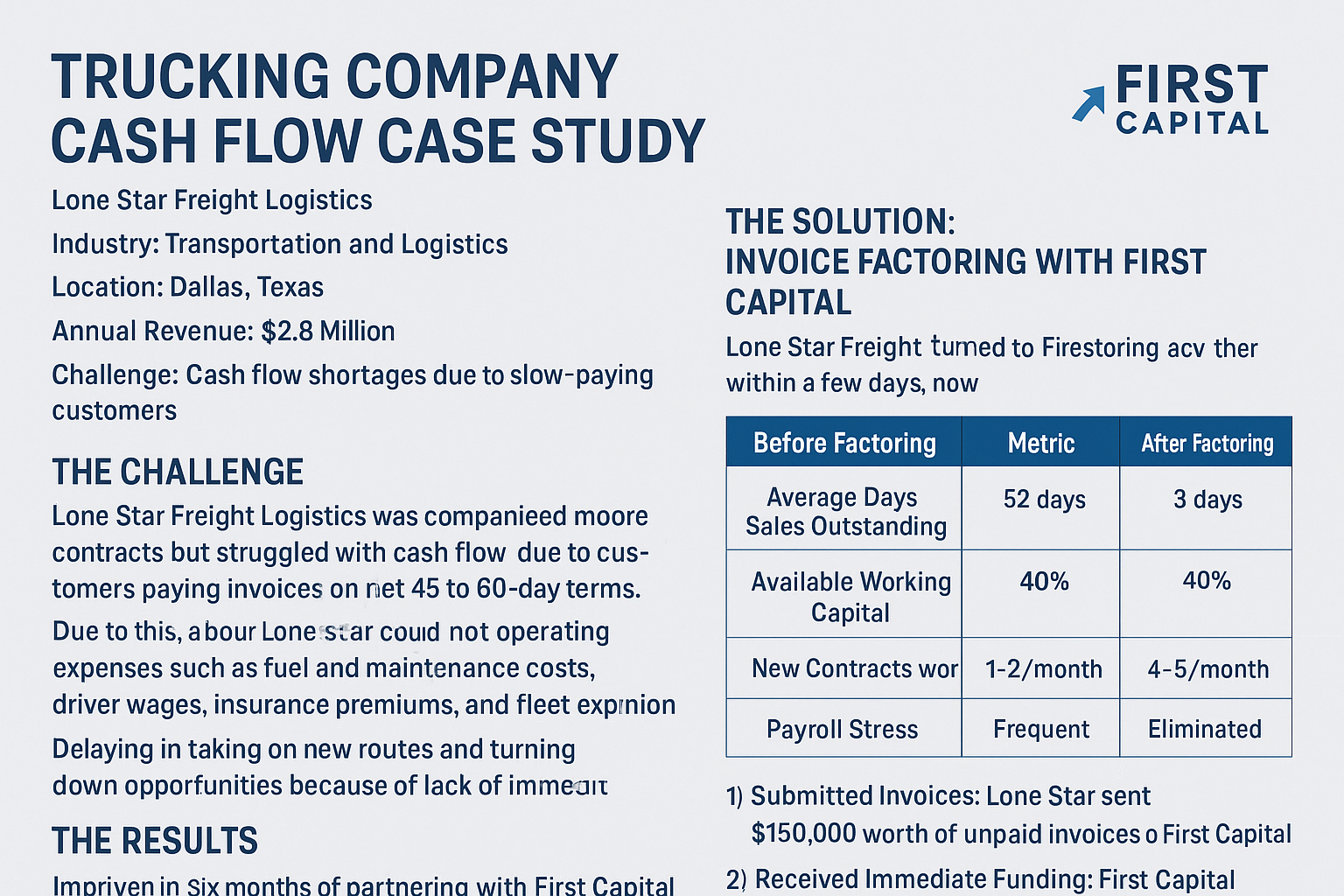

Company: Lone Star Freight Logistics

Industry: Transportation and Logistics

Location: Dallas, Texas

Annual Revenue: $2.8 Million

Challenge: Trucking Company Cash flow shortages due to slow-paying customers

The Trucking Company Cash Flow Challenge

Lone Star Freight Logistics was a small-sized trucking company that hauled freight across Texas and neighboring states. Business was booming — they had more contracts than ever before — but their cash flow couldn’t keep up with their growth.

Most of their customers were large distribution companies and manufacturers who paid invoices on net 45 to 60-day terms. While waiting to get paid, Lone Star still needed to cover critical operating expenses such as:

Driver wages

Insurance premiums

Fleet expansion

Despite strong sales, the company found itself short on working capital to meet day-to-day needs. They faced delays in taking on new routes and had to turn down opportunities simply because they lacked immediate cash flow.

The Solution: Invoice Factoring with First Capital

After exploring bank financing and being turned down due to long approval timelines and strict credit requirements, Lone Star Freight turned to First Capital Factoring for a faster, more flexible funding option.

Within just a few days, Lone Star set up a factoring line and began selling its outstanding invoices to First Capital at a small discount. Here’s how the process worked:

Submitted Invoices: Lone Star sent $150,000 worth of unpaid invoices to First Capital.

Received Immediate Funding: First Capital advanced 90% of the invoice value ($135,000) within 24 hours.

Customer Payment: Once Lone Star’s customers paid the invoices, the remaining 10% (minus a small factoring fee) was released.

This provided Lone Star with fast, predictable cash flow that allowed them to:

Pay drivers and suppliers on time

Accept more hauling contracts

Invest in fleet maintenance and new equipment

Stop worrying about late payments and focus on operations

The Results

Within six months of partnering with First Capital, Lone Star Freight Logistics saw measurable improvements:

| Metric | Before Factoring | After Factoring |

|---|---|---|

| Average Days Sales Outstanding (DSO) | 52 days | 3 days |

| Available Working Capital | Limited | Increased by 40% |

| New Contracts Won | 1–2/month | 4–5/month |

| Payroll Stress | Frequent | Eliminated |

Client Testimonial

“Partnering with First Capital was the smartest move we made this year. We finally had the cash flow to keep trucks moving, pay our team, and take on more routes without worrying about waiting on payments.”

— Carlos M., Owner of Lone Star Freight Logistics

Why Trucking Company Cash Flow by Factoring Worked

Factoring gave Lone Star the ability to turn unpaid invoices into immediate working capital, bridging the gap between delivering services and getting paid. Because factoring is based on the credit strength of the customer, not the business itself, Lone Star didn’t have to worry about poor credit or financial history.

Key Takeaway

Invoice factoring isn’t just for companies in trouble — it’s for growing businesses that need faster access to their earned cash. For industries like trucking, manufacturing, staffing, and construction, factoring is often the difference between stagnation and expansion.

About First Capital

First Capital provides invoice factoring and accounts receivable financing solutions for businesses across Texas and nationwide. Whether your company needs fast cash flow to cover payroll, expand operations, or take on new contracts, we can help.

👉 Contact First Capital today to learn how our Factoring programs can fuel your business growth.