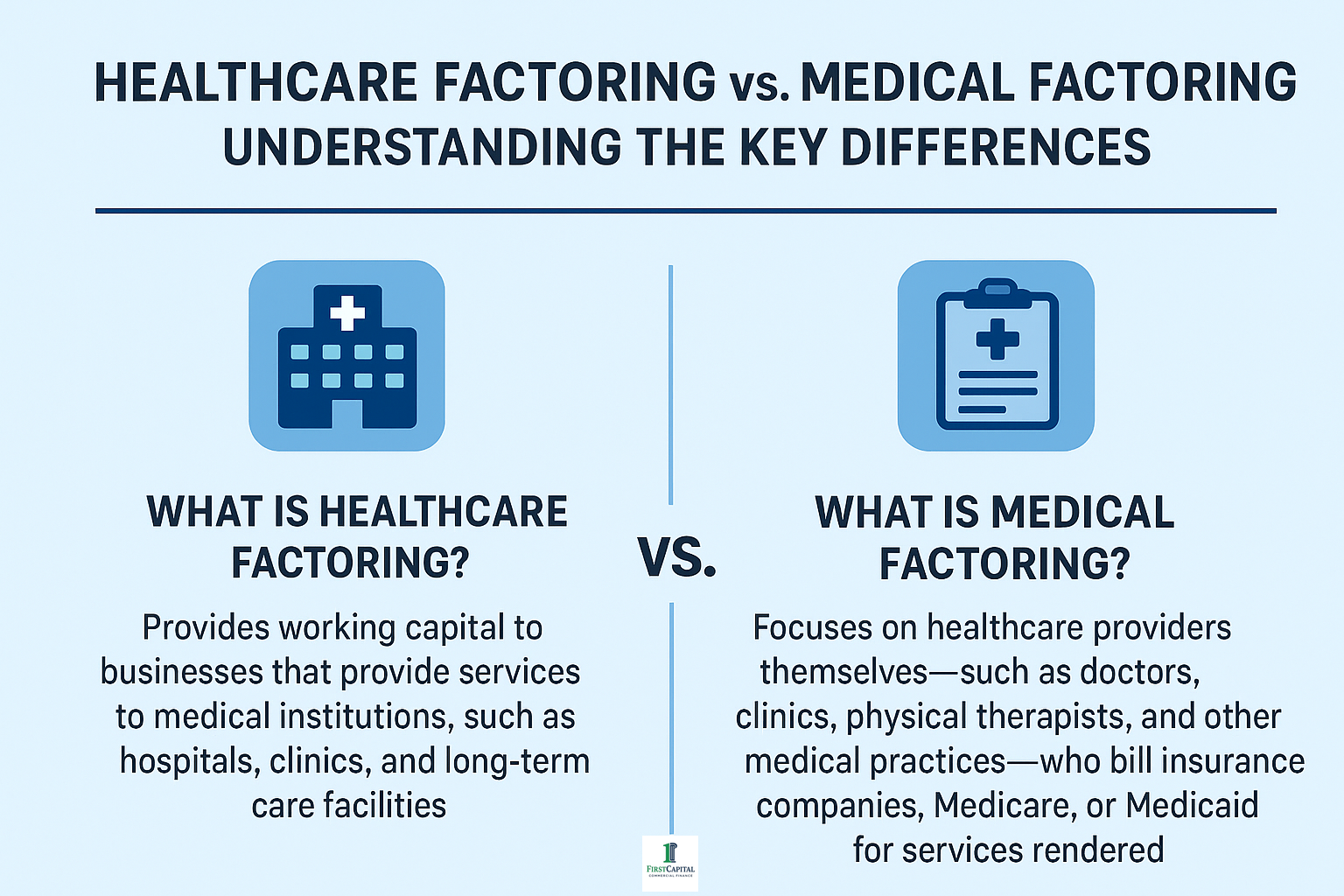

Healthcare Factoring vs. Medical Factoring: Understanding the Key Differences

When it comes to financing within the medical and healthcare industries, factoring is one of the most effective ways to […]

Healthcare Factoring vs. Medical Factoring: Understanding the Key Differences Read More »