Invoice Factoring Qualifications: What Your Business Needs to Know

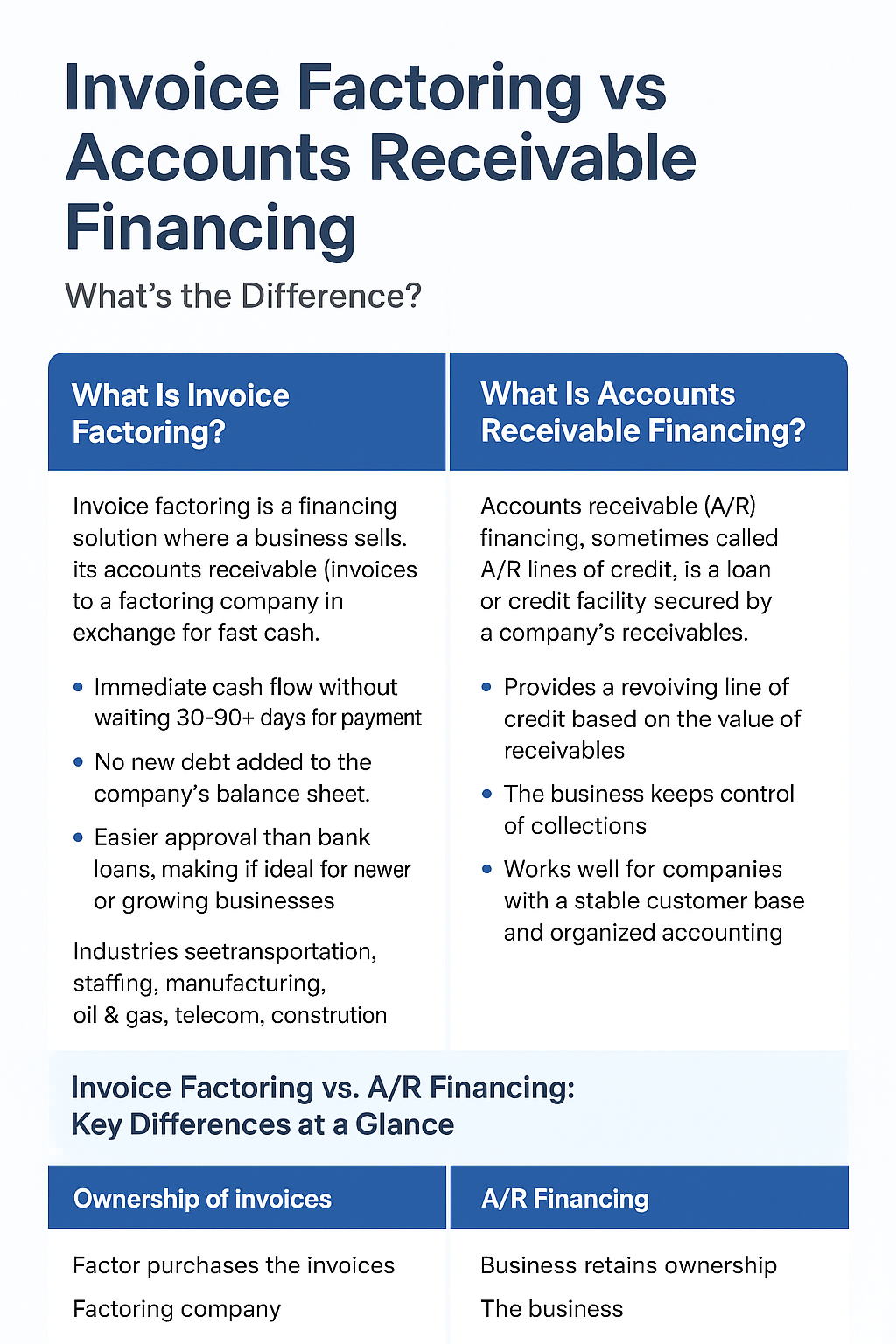

Invoice Factoring Qualifications: What Your Business Needs to Know Many small business owners assume invoice factoring qualifications are hard to […]

Invoice Factoring Qualifications: What Your Business Needs to Know Read More »