When it comes to financing within the medical and healthcare industries, factoring is one of the most effective ways to maintain steady cash flow. Still, many businesses confuse healthcare factoring vs medical factoring, assuming they are the same. To clarify, while the two are closely related, they serve different types of clients and have distinct eligibility and payment structures.

In this article, we’ll explain what each type of factoring involves, their key differences, eligibility requirements, and how First Capital helps healthcare and medical businesses get the funding they need.

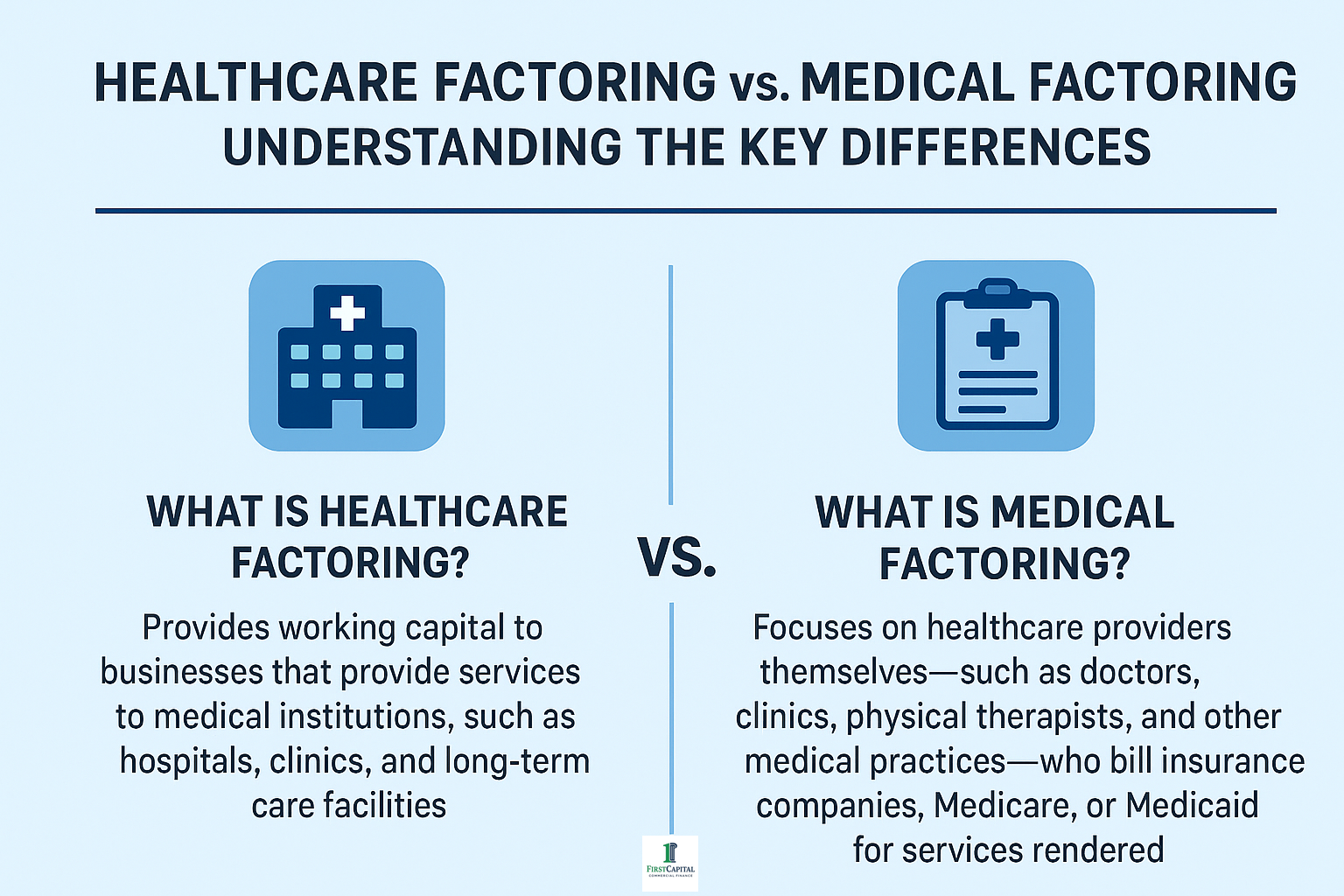

Healthcare vs Medical Factoring: What Is Healthcare Factoring?

In essence, Healthcare factoring provides working capital to businesses that provide services to medical institutions, such as hospitals, clinics, and long-term care facilities. As a result, these companies aren’t typically direct healthcare providers but rather vendors or service providers that support the medical industry.

Examples of businesses that use healthcare factoring include:

Medical staffing agencies

Healthcare IT and software companies

Medical equipment suppliers

Cleaning, logistics, and administrative service companies serving hospitals

When these businesses experience long payment cycles from healthcare institutions, factoring converts their unpaid invoices into immediate cash.

Healthcare vs Medical Factoring: What Is Medical Factoring?

By contrast, Medical factoring focuses on healthcare providers themselves—such as doctors, clinics, physical therapists, and other medical practices—who bill insurance companies, Medicare, or Medicaid for services rendered. Consequently, this type of factoring directly supports medical practices struggling with delayed reimbursements.

In medical factoring, the factor advances funds based on third-party medical receivables (insurance claims), helping providers overcome slow reimbursements and stabilize cash flow.

Core Difference in Scope

Ultimately, the main difference between healthcare factoring and medical factoring lies in who the invoices come from and who pays them:

Healthcare Factoring: Invoices are issued to healthcare institutions (like hospitals or nursing homes).

Medical Factoring: Invoices are issued to insurance companies or government payers (like Medicare and Medicaid).

Simply put, healthcare factoring deals with B2B (business-to-business) transactions, while medical factoring deals with B2G/B2I (business-to-government or business-to-insurance) transactions.

Healthcare vs Medical Factoring: Eligibility Requirements

Healthcare Factoring Eligibility:

To qualify, healthcare factoring applicants must provide services or products to a healthcare facility

Have verifiable invoices owed by creditworthy medical institutions

No liens or encumbrances on accounts receivable

Medical Factoring Eligibility:

Must be a licensed medical provider or practice

Must generate receivables from private insurance, Medicare, or Medicaid

Claims must be clean and verifiable with documentation

Can Medicare and Medicaid Be Factored?

Yes — but with specific restrictions.

In fact, direct factoring of Medicare and Medicaid claims is generally prohibited under federal law. Nevertheless, factoring companies like First Capital can structure financing around these receivables through medical receivables funding.

This process involves factoring the insurance portions or creating a non-notification funding agreement that legally complies with Medicare and Medicaid regulations.

How the Factoring Process Works

Typically, the factoring process follows these key steps:

Submit Invoices: The business or provider submits invoices or claims to the factor.

Verification: The factoring company verifies the validity of invoices or claims.

Advance: A cash advance (typically 70%–90%) is issued immediately.

Payment Collection: The factor collects payment from the healthcare institution or insurer.

Reserve Release: Once payment is received, the remaining balance (minus fees) is released.

Recourse vs. Non-Recourse Factoring

In most cases, both healthcare and medical factoring can be structured as recourse or non-recourse:

Recourse Factoring: The business is responsible if the client or payer fails to pay.

Non-Recourse Factoring: The factoring company assumes the payment risk if the payer defaults due to insolvency.

Non-recourse factoring is often preferred by medical providers since insurance defaults are uncommon but delays are frequent.

Benefits and Drawbacks

Benefits of Factoring:

Immediate cash flow without debt

Flexibility for growing practices and vendors

Outsourced collections and billing support

Smooths out cash flow gaps caused by slow-paying insurers or hospitals

Drawbacks:

Factoring fees reduce total profit margin slightly

Recourse agreements can shift risk back to the provider if invoices are uncollectible

Even so, despite these drawbacks, factoring remains one of the fastest and most reliable funding options for the healthcare sector.

Why Choose First Capital for Healthcare and Medical Factoring

First Capital is a trusted nationwide leader in healthcare and medical factoring, providing customized funding solutions for both service providers and healthcare professionals.

Our team understands the unique payment challenges of the medical industry — from Medicare delays to insurance claim cycles — and offers flexible funding designed to help your business thrive.

With fast approvals, competitive rates, and over 20 years of factoring experience, First Capital is the go-to choice for both healthcare vendors and medical practices seeking financial stability and growth. Call or Contact Us Today.